Advancing to Transformative Revenue Cycle

The Perfect Digital Strategy for Healthcare Organizations

Seema Nagwani

Sr. Healthcare consultant, CitiusTech

June 23

Article

Insights

- Effective healthcare systems not only enhances the efficiency and operability of the healthcare organization but also improves revenue, ensures adherence to compliances, and improves patient satisfaction.

- While organizations should aim to align Financial + Clinical + Operational goals, tying technological advances to it will add significant improvement to the defined revenue goals.

- The need for digitizing RCM includes changed payment responsibilities, a shift from volume to value-based care, and understanding financial details.

Healthcare organizations require the collaboration of – providers, payers, and beneficiaries (patients) to deliver high-quality and affordable care. Revenue Cycle Management (RCM) refers to the financial flows (across these entities) required to deliver high-quality care throughout the patient’s journey. Today, digital disruption can be seen everywhere because of the shift in payment responsibility, heightened administrative burdens, and regulatory shifts. The changes in payment models towards risk-sharing and VBC models have accelerated the growth of the RCM market, and it is anticipated to reach more than $43 billion by 2023.

According to a survey by HFMA, 78% of healthcare organizations reported that value-based care contracts have a positive impact on their RCM.

Article

Drug Discovery in a Post-Pandemic Era | How Data Interoperability Will Accelerate Innovations ...

Importance of RCM in Healthcare Organizations

Revenue Cycle Management is critical for healthcare organizations as it enhances the efficiency and operability of the healthcare organization. These benefits are crucial for any healthcare organization's growth, leading to healthcare organizations adapting themselves to embrace digitized RCM. Recent survey by the Healthcare Financial Management Association (HFMA) found that hospitals with effective RCM processes had a median collection rate of 95% compared to 73% for organizations with ineffective RCM.

Need for Shift to 'Transformative' and 'Digitized' RCM:

Revenue collection has become challenging due to shifting costs. As per a survey, 56% of patients report the reason for the delay in paying medical bills is confusion over their EOB understanding.

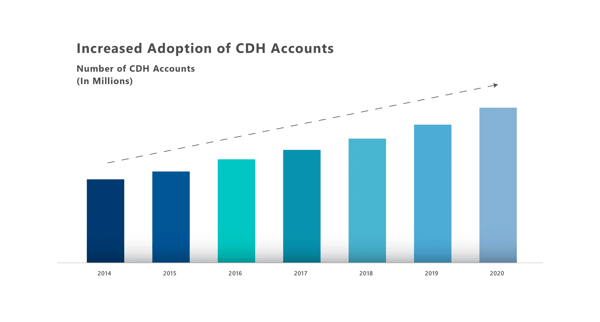

Exhibit 1: Growth in CDH accounts

Patients expect 'retail' industry experience in healthcare. This model prioritizes and places the 'patient' at the centre of the care continuum.

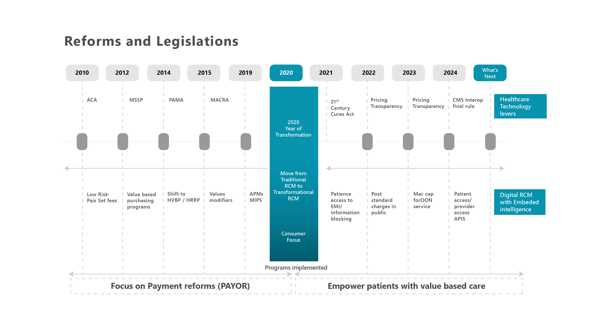

The ‘alphabet soup’ of regulatory forces such as ACO/MACRA/ MIPS/ VBC/ APM’s/ Bundles payment models/ MSSP’s etc. and the impact needs to be understood in detail:

- Even SDoH factors like smoking addiction, has an underlying impact on billing/collections and, thus, the bottom line.

- SDoH risk correlates to no-shows and appointment cancellations and thus lost utilization and missed revenue.

The below exhibit shows the shift from payment reforms to more patient-centric regulations introduced, which acts as a trigger to steadily shift towards next-gen RCM: (Exhibit 2)

Exhibit 2: Shift in regulations

AHRQ Studies show that up to 50% of physicians experience some level of burnout. This is adding to staff burnout and, thus, missed $ revenue.

Traditional RCM focus was on capturing revenue which has now shifted to driving revenue. This is achieved through aligning Financial + Clinical + Operational goals and tying technological advances to it.

What if Organizations do not Step-Ahead with the Transformative Model?

Implications

-

Shift in payment responsibility demands more FTEs for patient collection. If not fulfilled, organizations can have a huge negative impact on cash flow.

-

Shift from volume to value-based care demands more focus on the quality of care.

-

Financial pressures: Providers continue to struggle to receive reimbursement for the services as new regulations (see Exhibit 2) are introduced. Providers need to understand all the concepts like Balance Billing/provide meaningful comparisons prior to receiving care/participate in different care delivery models.

-

Administrative burden: Nursing and staff burnout will directly impact the quality of care.

Looking at the above factors, the top four industry revenue cycle challenges revolve around optimizing net revenue, reducing cost-to-collect, increase in cash flow, and digitizing patient financial journey.

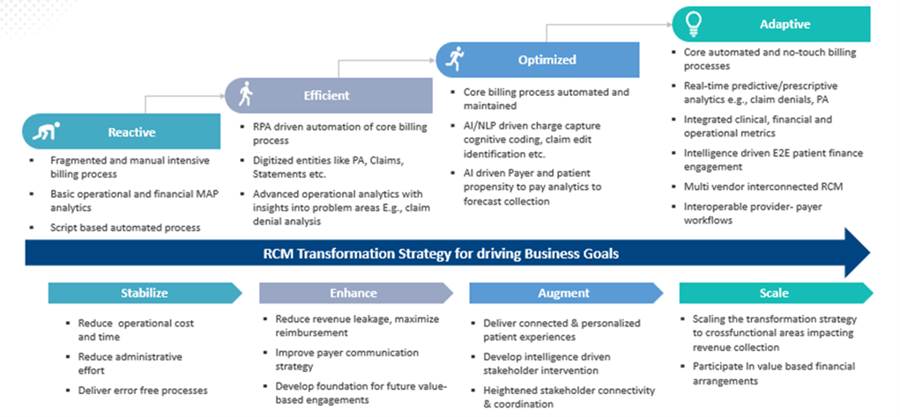

Across industries, there has been a significant shift towards hyper automation and cognitive solutions. Below steps should define how RCM vendors should take step-by-step process from learner approach to an advanced stage. Below exhibit represents the maturity model for an organization to drive the revenue business goals: [Automate for efficiency -> Operational excellence -> embedded intelligence in existing processes along with advanced analytics]

Exhibit 3: RCM digital transformation strategy

Few examples of evolved solutions around ‘transformative RCM’ could be:

- Patient price estimator tool – Transparent out-of-pocket cost estimates is need of the hour in accordance with the Pricing Transparency Act, 2021. This is provided based on the prior claims data and be customized for highly utilized DRG codes/service codes etc.

- Automated scheduler – Auto-scheduling patients by using RPA bots; sending automated reminders for first appointment/ follow-up/ already rescheduled appointments will help in reduced no-shows and missed appointments.

- Real time patient eligibility-check and retrieval - The AI tools can retrieve real time eligibility from the payor and shall create an OOP cost estimates unique to a patient. Out-of-pocket expense amounts to 30% of the total healthcare bill.

- Reengineer patient financial journey - Interactive patient liability reminders at each needed step. Most of the collections can be achieved if patient is involved at the start of the care. Automated patient financial reach out post financial counselling sessions with appropriate outreach channels.

- Out of network alerts on scheduling any appointment with out-network physicians. Special alerts on cancelations across co-located clinics so other patients on wait list can be scheduled.

- Auto-suggest slots for subsequent services to be performed (e.g.: if booked slot for HbA1C, auto-suggest Creatinine Blood Test available slots within 48 hours).

- Prior authorization – ePA (electronic PA) requests should be initiated at the point of care to avoid any delays in receiving PS response. NLP (Natural Language Processing) to accelerate the required information extraction (authorization number, archived payor screenshots etc.) will help save time to a great extent.

- Gold carding for high performing providers needs to be introduced which will help increase in care outcome happening due to delay in authorizations.

- CDShooks - The provider doesn’t need to bother about the coverage of a drug. As a drug/ service is entered in the EHR, the hook will trigger a query to payor's data base regarding the coverage.

- CDM Master data management – Chargemaster is always a moving data, snippet of current coding and clinical data flowing from one PAS system to multiple systems. Provide a clear and concise view of Hospital’s CDM data across service lines, Cost center to ensure accurate pricing and coding.

- Contract modelling leveraging multiple contracts from payor and generating pricing policies based on payor-mix identifying revenue shortfalls for each contracted payor.

- Focus on expensive denials – Highlighting the outlier denials and possible causes of such denials via means of accurate CARC/RARC codes and ingesting these rules into the claims processing engine will lead to a significant shift from Actionable denial à Preventive denials.

- Digitization in processes like Prior authorization, billing and collections, claims tracking, reasons for denials, claims status etc.

Summary

Traditionally, it was all about patient experience from service to billing; now the focus has shifted to a ‘consumerism’ model from pre-service to post-services. Across industries, there has been a significant shift toward hyper automation and cognitive solutions. Maturing initial processes will help the organizations become stabilized in core processes to draw a co-relation between impact vs. efficiency and move further to achieve operational excellence around high burden areas. Moving towards optimizing those processes via embedded intelligence and advanced analytics will successfully help scale the transformation across verticals.

Depending on all the above considerations, organizations should be evaluated based on the current state and future aspirations for adopting RCM digital strategy.

To be able to ride the wave of the complex regulations, providers will have to regroup and review their current business strategy with RCM as a key area for investment on the digital front.